UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Filed by the Registrant ☒ | Filed by a Party other than the Registrant o |

Check the appropriate box:

o | ||

Preliminary Proxy Statement | ||

o | ||

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | ||

Definitive Proxy Statement | ||

o | ||

Definitive Additional Materials | ||

o | ||

Soliciting Material Pursuant to §240.14a-12 |

GNC HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

GNC HOLDINGS, INC. |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | |||||

No fee required. | |||||

o | |||||

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||||

(1) | |||||

Title of each class of securities to which transaction applies: | |||||

(2) | Aggregate number of securities to which transaction applies: | ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

(4) | Proposed maximum aggregate value of transaction: | ||||

(5) | Total fee paid: | ||||

o | Fee paid previously with preliminary materials: | ||||

o | |||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||||

(1) | |||||

Amount previously paid: | |||||

(2) | Form, Schedule or Registration Statement No.: | ||||

| |||||

(3) | Filing Party: | ||||

(4) | Date Filed: | ||||

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

March 26, 2018April 11, 2019

Dear Stockholder,

You are cordially invited to attend a Specialthe Annual Meeting of Stockholders of GNC Holdings, Inc. (the “Company”) to be held on April 25, 2018Tuesday, May 21, 2019 at 8:3000 a.m., Eastern Time at the Omni William Penn Hotel, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219 (the “Special Meeting”).15219.

On February 13, 2018,The agenda for the Company entered intoAnnual Meeting includes:

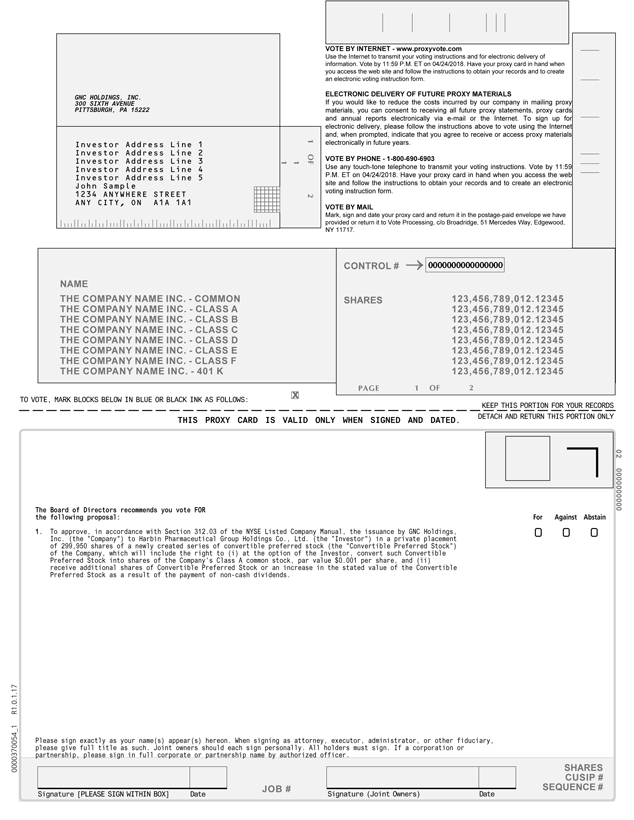

At the Special Meeting, you will be asked to consider and vote on a proposal to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of the Convertible Preferred Stock to the Investor, which Convertible Preferred Stock will include the right to (i) at the option of the Investor, convert such Convertible Preferred Stock into shares of the Company’s Common Stock and (ii) receive additional shares of Convertible Preferred Stock or an increase in the stated value of the Convertible Preferred Stock as a result of the payment ofnon-cash dividends (the “Share Issuance”).

Our Board of Directors unanimously recommends that you vote “FOR” the Share Issuance.

Stockholders of record at the close of business on March 23, 2018 are entitled to notice of,FOR Proposals 1, 2, and to vote at, the Special Meeting or any adjournment or postponement thereof.3.

Your interest in the Company and your vote are very important to us. The enclosed proxy materials contain detailed information regarding the proposalbusiness that will be considered at the SpecialAnnual Meeting. We encourage you to read the proxy materials and vote your shares as soon as possible. You may vote your proxy via the Internet or telephone or, if you received a paper copy of the proxy materials, by mail by completing and returning the proxy card in the accompanying prepaid reply envelope.

Whether or not you plan to attend the Special Meeting, please complete, date, sign and return, as promptly as possible, the enclosed proxy card in the accompanying prepaid reply envelope, or submit your proxy by telephone or the Internet. If you attend the Special Meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.

If your shares of Common Stock are held in “street name” by your bank, brokerage firm or other nominee, your bank, brokerage firm or other nominee will be unable to vote your shares of Common Stock without instructions from you. You should instruct your bank, brokerage firm or other nominee to vote your shares of Common Stock in accordance with the procedures provided by your bank, brokerage firm or other nominee.

If you have any questions or need assistance voting your shares of Common Stock, please contact Georgeson LLC, our proxy solicitor, by calling toll-free at (888)607-9107.card.

On behalf of the Company,GNC, I would like to express our appreciation for your ongoing interestinvestment in GNC.the Company.

Live Well, | |

| |

| |

Kenneth A. Martindale | |

Chairman and Chief Executive Officer |

GNC HOLDINGS, INC.

NOTICE OF

SPECIAL

2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 25, 2018

MAY 21, 2019

DATE AND TIME | 8: | ||

PLACE | Omni William Penn Hotel 530 William Penn Place Pittsburgh, Pennsylvania 15219 | ||

ITEMS OF BUSINESS | (1) | To | |

(2) | To approve, by non-binding vote on | ||

(3) | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our 2019 fiscal year (Proposal 3). | ||

(4) | To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof. | ||

RECORD DATE | You are entitled to vote only if you were a stockholder of record at the close of business on March | ||

PROXY VOTING | It is important that your shares be represented and voted at the | ||

REQUIRED VOTE | The affirmative vote of a majority of the | ||

March 26,Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 21, 2019: As permitted by rules adopted by the Securities and Exchange Commission, rather than mailing a full paper set of these proxy materials, we are mailing to many of our stockholders only a notice of Internet availability of proxy materials containing instructions on how to access these proxy materials and submit their respective proxy votes online. This proxy statement, our 2018 Annual Report on Form 10-K and the proxy card are available at www.proxyvote.com. You will need your notice of Internet availability or proxy card to access these proxy materials.

April 11, 2019

| Susan M. Canning |

Secretary |

- i -

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

SPECIAL2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 25, 2018

May 21, 2019

The Board of Directors (the “Board”) of GNC Holdings, Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), has prepared this document to solicit your proxy to vote upon certain matters at a specialour 2019 annual meeting of our stockholders (the “Special“Annual Meeting”).

These proxy materials contain information regarding the SpecialAnnual Meeting, to be held on April 25, 2018,Tuesday, May 21, 2019, beginning at 8:3000 a.m., Eastern Time at the Omni William Penn Hotel, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219, and at any adjournmentsadjournment or postponementspostponement thereof. As permitted by the rules adopted by the Securities and Exchange Commission (the “SEC”), rather than mailing a full paper set of these proxy materials, we are mailing to many of our stockholders only a notice of Internet availability of proxy materials (the “Notice”) containing instructions on how to access and review these proxy materials and submit their respective proxy votes online. If you receive the Notice and would like to receive a paper copy of these proxy materials, you should follow the instructions for requesting such materials located at www.proxyvote.com.

QUESTIONS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS

It is anticipated that we will begin mailing this proxy statement, andthe proxy card, our Annual Report on Form 10-K for the year ended December 31, 2018 (the “Annual Report”) and the Notice, and that these proxy materials will first be made available online to our stockholders, on or about March 26, 2018.April 11, 2019. The information regarding stock ownership and other matters in this proxy statement is as of March 23, 201825, 2019 (the “Record Date”), unless otherwise indicated.

QUESTIONS ABOUT THE SPECIAL MEETING AND THESE PROXY MATERIALSWhat may I vote on?

Why am I receiving this proxy statement?

We are sending you this proxy statement because the Board is soliciting your proxy to vote at the Special Meeting to be held on April 25, 2018, at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219, and any adjournments or postponements of the Special Meeting. This proxy statement summarizes information that is intended to assist you in making an informedYou may vote on the proposalfollowing proposals:

What is the purposeapproval, by non-binding vote, on an advisory basis of the Special Meeting?

On February 13,compensation paid to our Named Executive Officers for 2018, as disclosed in these proxy materials (commonly known as a “say-on-pay” proposal) (Proposal 2); and

THE BOARD RECOMMENDS A VOTE (1) FOR THE ELECTION OF EACH OF OUR NOMINEES FOR DIRECTORS (PROPOSAL 1), (2) FOR THE APPROVAL, BY NON-BINDING VOTE ON AN ADVISORY BASIS, OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS FOR 2018 (“SAY-ON-PAY”) to be filed by the Company with the Secretary of State of the State of Delaware prior to the closing of the transaction. The Certificate of Designations is described in more detail in the section entitled“Description of the Convertible Preferred Stock” below.

In connection with the Securities Purchase Agreement, we will enter into a stockholders agreement (the “Stockholders Agreement”) with the Investor, which will provide for certain rights and responsibilities of the

parties in connection with the Investor’s investment and the governance of the Company, and a registration rights agreement (the “Registration Rights Agreement”) with the Investor, which will provide for the obligation of the Company, at the request of the Investor, to register the resale of the Common Stock underlying the Convertible Preferred Stock with the U.S. Securities and Exchange Commission (the “SEC”). In addition, the Securities Purchase Agreement provides for the parties to use reasonable best efforts to negotiate definitive documentation with respect to a commercial joint venture in China (the “Joint Venture”)(PROPOSAL 2), pursuant to which, among other things, the Joint Venture would be granted an exclusive right to use the Company’s trademarks and manufacture and distribute the Company’s products in China (excluding Hong Kong, Taiwan and Macau)AND (3) FOR THE RATIFICATION OF THE APPOINTMENT OF PWC AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL 3). The Company would receive royalties on all products sold by the Joint Venture. The Joint Venture would be owned 65% by the Investor and 35% by the Company. The Stockholders Agreement, the Registration Rights Agreement and the Joint Venture are described in more detail in the section entitled“Description of the Transaction Documents” below.

Additionally, on February 28, 2018, the Company completed the refinancing of the Company’s Existing Credit Agreement (as defined below), which provided for (i) the amendment and restatement of the Company’s Existing Credit Agreement to extend the maturity date of certain term loans of the Company, (ii) the repayment in full and termination of the Company’s revolving credit facility, (iii) the repayment of a portion of the Company’s existing term loans and (iv) the entrance into a new asset-based term loan facility. These financing-related transactions satisfy the condition to completion of the issuance, purchase and sale of the Convertible Preferred Stock with respect to the Credit Agreement Refinancing (as defined in the Securities Purchase Agreement). More information regarding these financing-related transactions can be found in the section entitled “Description of the Share Issuance” below.

In accordance with the Securities Purchase Agreement and applicable rules, regulations and guidance of the New York Stock Exchange (the “NYSE”), the Company is calling the Special Meeting to consider and vote upon a proposal to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of the Convertible Preferred Stock to the Investor, which Convertible Preferred Stock will include the right to (i) at the option of the Investor, convert such Convertible Preferred Stock into shares of the Company’s Common Stock and (ii) receive additional shares of Convertible Preferred Stock or an increase in the stated value of the Convertible Preferred Stock as a result of the payment ofnon-cash dividends (the “Share Issuance”).

How does the Board recommend that I vote?

After consulting with its financial advisors and outside legal counsel and after reviewing and considering the terms and conditions of the Share Issuance and the factors more fully described in this proxy statement, the Board unanimously (i) approved the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance; (ii) determined that the terms of the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance, are fair to, and in the best interests of, the Company and its stockholders; (iii) directed that the Share Issuance be submitted to the stockholders of the Company for approval; (iv) recommended approval of the Share Issuance by the Company’s stockholders; and (v) declared that the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance, are advisable.

The Board unanimously recommends that the Company’s stockholders vote “FOR” the proposal to approve the Share Issuance.

What are the principal conditions to consummation of the Share Issuance?

The obligations of the Company and the Investor to complete the issuance, purchase and sale of the Convertible Preferred Stock are subject to the satisfaction or waiver (to the extent permitted by applicable law) by the Company and the Investor at or prior to the Closing of the following conditions:

The Company and the Investor (i) have agreed that the condition that the Company complete the Credit Agreement Refinancing has been satisfied, and (ii) have determined that no filings are required with respect to the Share Issuance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and that, accordingly, the condition with respect to an HSR Act filing is deemed to be satisfied.

See the section entitled “Description of the Transaction Documents—Securities PurchaseAgreement—Conditions to Completion of the Issuance, Purchase and Sale of the Convertible Preferred Stock” below for a full description of the conditions to consummating the Share Issuance.

What happens if the Share Issuance is not completed?

If the Share Issuance is not approved by the Company’s stockholders, or if another condition to the consummation of the Share Issuance is not satisfied, the Share Issuance will not be completed and the Securities Purchase Agreement may be terminated.

Under specified circumstances following the termination of the Securities Purchase Agreement, we may be required to pay the Investor a termination fee or to reimburse certain of the Investor’s transaction expenses, or we may be entitled to receive a reverse termination fee from the Investor, as described in the section entitled “Description of the Transaction Documents—Securities Purchase Agreement— Termination of the Securities Purchase Agreement” below.

Why is stockholder approval necessary for the Share Issuance?

Our Common Stock is listed on the NYSE and we are subject to the NYSE rules and regulations. Section 312.03(c) of the NYSE Listed Company Manual requires stockholder approval prior to any issuance of common stock, or of securities convertible into common stock, in any transaction or series of related transactions if (1) the common stock to be issued has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock, or (2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock.

At the closing of the Share Issuance, the Convertible Preferred Stock to be sold to the Investor will be convertible, at the option of the Investor, into 56,065,421 shares of Common Stock (subject to adjustment), which represents greater than 20% of both the voting power and number of shares of our Common Stock outstanding prior to the issuance. Because the sale of the Convertible Preferred Stock to the Investor exceeds 20% of both the voting power and number of shares of our Common Stock outstanding prior to the issuance and would implicate Section 312.03(c) of the NYSE Listed Company Manual and, since the NYSE rules do not define “change of control,” possibly 312.03(d) of the NYSE Listed Company Manual, we must seek stockholder approval prior to making such issuance. Further, we are obligated to seek such stockholder approval pursuant to the Securities Purchase Agreement.

When and where is the Special Meeting?

The Special Meeting will take place on April 25, 2018 at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219.

Pursuant to our Fifth Amended and Restated Bylaws (the “Bylaws”), either our Board or the presiding person of the Special Meeting has the power to recess and/or adjourn the meeting, for any or no reason, to another place, date and time. We intend to adjourn the Special Meeting to solicit additional proxies if there are insufficient votes at the Special Meeting to approve the Share Issuance.

If the Special Meeting is adjourned to another time or place, the Company may transact any business which might have been transacted at the original meeting. If the meeting is adjourned for 30 days or fewer and no new record date is set for the adjourned meeting, the time and place of the adjourned meeting will be announced at the Special Meeting and no other notice will be sent to stockholders.

Who may vote?

Stockholders of record, of our Common Stock at the close of business on the Record Date are entitled to receive the Notice and these proxy materials and to vote their respective shares at the SpecialAnnual Meeting. Each share of our Class A common stock, par value $0.001 per share (“Common StockStock”) is entitled to one vote on each matter that is properly brought before the SpecialAnnual Meeting. As of the Record Date, there were 83,661,96583,966,049 shares of Common Stock issued and outstanding.

Each share of our Series A Convertible Preferred Stock, par value $0.001 per share (“Preferred Stock”) is entitled to a number of votes equal to the number of shares of Common Stock that such Preferred Stock may convert into as of the

1

Record Date, calculated by dividing (i) the applicable liquidation preference, which as of the Record Date is $1,000.00 per share, by $5.35 per share, and disregarding any fractional shares into which such aggregate number is convertible. As of the Record Date, there were 299,950 shares of Preferred Stock issued and outstanding, entitling the holder thereof to cast 56,065,420 votes.

Holders of our Common Stock and Preferred Stock vote together as a single class on all matters presented to the stockholders for their vote or approval, except as may otherwise be required by Delaware Law or the terms of our Certificate of Incorporation, as amended and restated. Under the terms of the Stockholders Agreement, entered into November 8, 2018 (the “Stockholders Agreement”) between the Company and Harbin Pharmaceutical Group Co., Ltd. (“Harbin”), the current holder of our Preferred Stock, Harbin has agreed for so long as it holds at least fifteen percent (15%) of the Company’s common stock (on an as-converted basis) to vote either in accordance with the recommendations of the Board or in accordance with the relative percentage votes of the Common Stock.

How do I vote?

We encourage you to vote your shares via the Internet. How you vote will depend on how you hold your shares of Common Stock.

Stockholders of Record

If your Common Stock is registered directly in your name with our transfer agent, American Stock, Transfer & Trust Company, LLC, you are considered a stockholder of record with respect to those shares, and a full paper set of these proxy materials is being sent directly to you. As a stockholder of record, you have the right to vote by proxy.

You may vote by proxy in any of the following three ways:

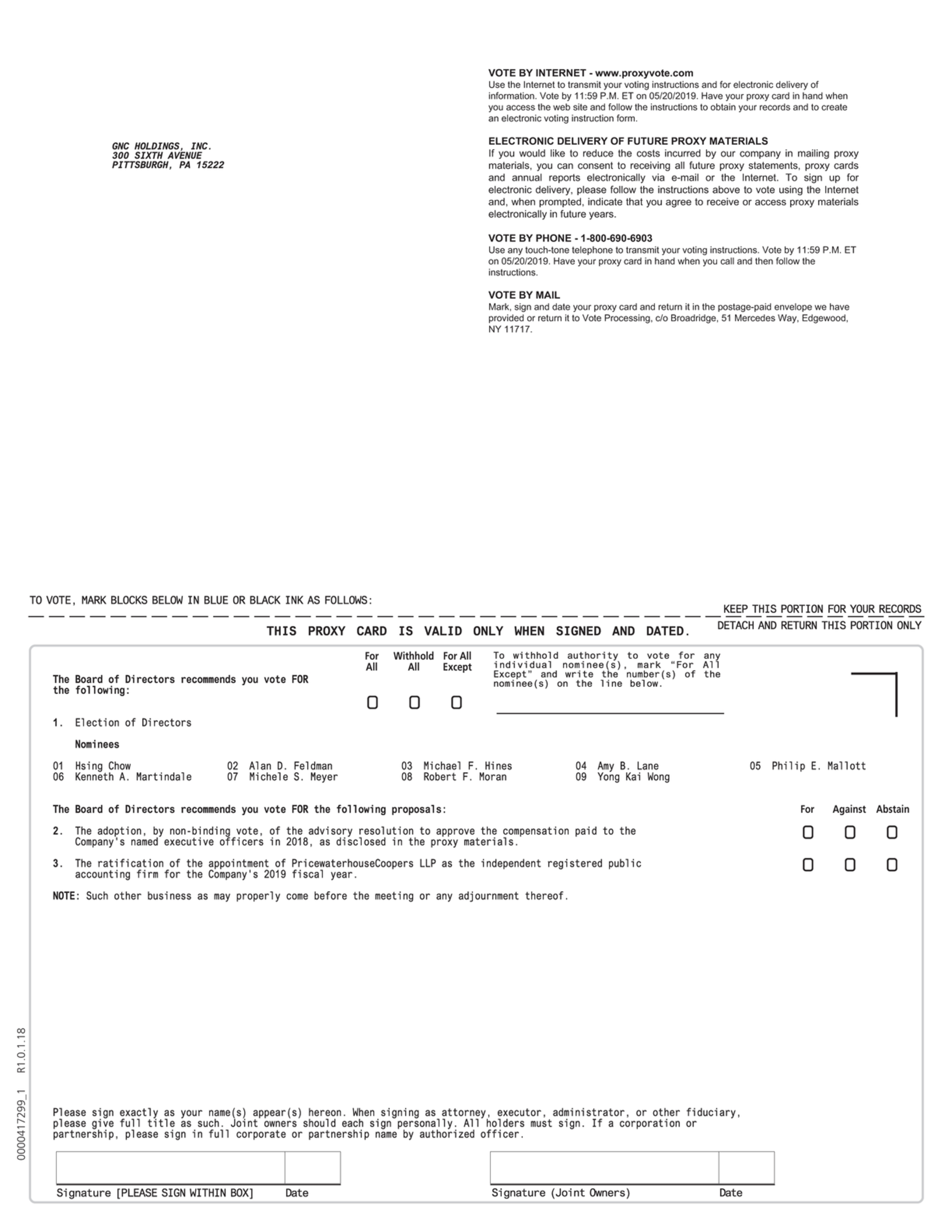

InternetInternet.. Go to www.proxyvote.com to use the Internet to transmit your voting instructions.instructions and for electronic delivery of information. Have your proxy card in hand when you access the website.

PhonePhone.. Call1-800-690-6903 using any touch-tone telephone to transmit your voting instructions. Have your proxy card in hand when you call.

MailMail.. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided, or return it in your own envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Voting by any of these methods will not affect your right to attend the SpecialAnnual Meeting and vote in person. However, for those who will not be voting in person at the SpecialAnnual Meeting, your final voting instructions must be received by no later than 11:59 p.m., Eastern Time on April 24, 2018.May 20, 2019.

Beneficial Owners

Most of our stockholders hold their shares through a broker,stockbroker, bank or other nominee, rather than directly in their own name.names. If you hold your shares in one of these ways, you are considered the beneficial owner of shares held in street name, and the proxy materials areNotice is being forwarded to you by your broker, bank or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote. Your broker, bank or nominee has enclosed a voting

instruction form for you to use in directing the broker, bank or nominee on how to vote your shares. If you hold your shares through an NYSEa New York Stock Exchange (“NYSE”) member brokerage firm, that member brokerage firm does not havehas the discretion to vote shares it holds on your behalf without instructions from you with respect to the Share Issuance. ForProposal 3 (the ratification of PwC as our independent registered accounting firm for our 2019 fiscal year), but not with respect to Proposal 1 (the election of directors) or Proposal 2 (the “say-on-pay” proposal) as more information, seefully described under “What is a broker‘non-vote’ ‘non-vote’?” below.

May I attend the Special Meeting and vote in person?

Yes. All stockholders of record as of the Record Date may attend the Special Meeting and vote in person. Stockholders will need to present proof of ownership of our Common Stock as of the Record Date, such as a bank or brokerage account statement, and a form of personal identification to be admitted to the Special Meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Special Meeting.2

Even if you plan to attend the Special Meeting in person, we encourage you to complete, sign, date and return the enclosed proxy to ensure that your shares of our Common Stock will be represented at the Special Meeting. If you attend the Special Meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.TABLE OF CONTENTS

If you are a beneficial owner and hold your shares of Common Stock in “street name” through a broker, bank or nominee, you should instruct your broker, bank or nominee on how you wish to vote your shares of Common Stock using the instructions provided by your broker, bank or nominee. Your broker, bank or nominee cannot vote on the proposal to approve the Share Issuance without your instructions. If you hold your shares of Common Stock in “street name,” because you are not the stockholder of record, you may not vote your shares of Common Stock in person at the Special Meeting unless you request and obtain a valid proxy in your name from your broker, bank or nominee.

Can I change my vote?

Yes. If you are the stockholder of record, you may revoke your proxy before it is exercised by doing any of the following:

Beneficial owners should contact their broker, bank or nominee for instructions on changing their votes.

How many votes must be present to hold the SpecialAnnual Meeting?

A “quorum” is necessary to hold the SpecialAnnual Meeting. A quorum is considered present if a majority of the votes entitled to be cast by the stockholders entitled to vote at the Special Meeting are represented in person or by proxyAnnual Meeting. They may be present at the Special Meeting.Annual Meeting or represented by proxy. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. Broker“non-votes” will not be counted as present and entitled to vote for purposes of determining a quorum at the Special Meeting.

How many votes are needed to approve the Share Issuance?proposals?

Pursuant toAt the rules of the NYSE, the approval of the Share Issuance requires the affirmativeAnnual Meeting, a “FOR” vote ofby a majority of votes cast is required for each of the shares present (in person orproposals described in this proxy statement: Proposal 1 (the election of directors), Proposal 2 (the “say-on-pay” proposal), and Proposal 3 (the ratification of PwC as independent registered accounting firm for our 2019 fiscal year).

For Proposals 1, 2 and 3, a “FOR” vote by proxy) and entitled to vote at the Special Meeting. Thisa “majority of votes cast” means that there must be more votes “FOR” the proposal thannumber of shares voted “FOR” exceeds the aggregatenumber of votes “AGAINSTshares voted “AGAINST.” the proposal plus abstentions at the Special Meeting. Broker“non-votes” will have no effect on the outcome of this vote.

What is an abstention?

An abstention is a properly signed proxy card that is marked “ABSTAIN.“ABSTAIN.” In the case of Proposals 1, 2 and 3, abstentions do not constitute votes “FOR” or votes “AGAINST” and, therefore, will have no effect on the outcome of any of those proposals.

Pursuant to the rules of the NYSE, abstentions are counted as present for purposes of determining a quorum, but will be counted as votes “AGAINST” the proposal to approve the Share Issuance.

What is a broker“non-vote? “non-vote?”

A broker“non-vote” “non-vote” occurs when a broker, bank or nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received timely instructions from the beneficial owner. Under current applicable rules, the proposal to approve the Share Issuance at the Special MeetingProposal 3 (the ratification of PwC as independent registered accounting firm for our 2019 fiscal year) is not a “discretionary” item upon which NYSE member brokerage firms that hold shares as nominee may vote on behalf of the beneficial owners if such beneficial owners have not furnished voting instructions by the tenth day before the SpecialAnnual Meeting. Therefore,

However, NYSE member brokerage firms that hold shares as a nominee may not vote on behalf of the beneficial owners on the Share IssuanceProposal 1 (the election of directors) or Proposal 2 (the “say-on-pay” proposal) unless you provide voting instructions.

If an Therefore, if a NYSE member brokerage firm holds your Common Stock as a nominee, please instruct your broker how to vote your Common Stock.Stock on each of these proposals. This will ensure that your shares are counted.

counted with respect to each of these proposals. Broker“non-votes” will “non-votes” do not be counted as presentconstitute votes “FOR” or votes “AGAINST” and entitled to vote for purposes of determining a quorum at the Special Meeting andtherefore will have no effect on the vote to approveoutcome of any of the Share Issuance.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares of our Common Stock in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares of Common Stock are registered in more than one name, you will receive more than one proxy card. Please complete, date, sign and return each proxy card and voting instruction card that you receive. Each proxy card you receive comes with its own prepaid return envelope; if you submit a proxy by mail, make sure you return each proxy card in the return envelope that accompanies that proxy card or return it in your own envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.proposals.

Will any other matters be acted on at the SpecialAnnual Meeting?

Pursuant to our Bylaws, only such business as is specified in this proxy statement will be conductedIf any other matters are properly presented at the Special Meeting.

Where can I findAnnual Meeting or any adjournment or postponement thereof, the voting resultspersons named in the proxy will have discretion to vote on those matters. As of December 11, 2018, the date by which any proposal for consideration at the Annual Meeting submitted by a stockholder must have been received by us to be presented at the Annual Meeting, and as of the Special Meeting?

The Company intendsdate of these proxy materials, we did not know of any other matters to announce preliminary voting resultsbe presented at the Special Meeting and publish final results in a Current Report on Form8-K that will be filed with the SEC following the SpecialAnnual Meeting. All reports that the Company files with the SEC are publicly available when filed. See the section entitled “Where You Can Find More Information” below.

3

Who pays for this proxy solicitation?

We will pay the expenses of soliciting proxies. In addition to solicitation by mail, proxies may be solicited in person or by telephone or other means by our directors or associates for no additional compensation. We will reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by them in mailing these proxy materials to the beneficial owners of Common Stock held of record by such persons.

In addition, we have retained Georgeson LLC to assist in the solicitation of proxies and otherwise in connection with the Special Meeting for an estimated fee of $8,500, plus reimbursement of certain reasonable expenses.

WhoWhom should I call with other questions?

If you have additional questions about these proxy materials or the SpecialAnnual Meeting, please contact: GNC Holdings, Inc., 300 Sixth Avenue, Pittsburgh, Pennsylvania, 15222, Attention: Secretary; Telephone: (412) 288-4600.

4

ELECTION OF DIRECTORS

(PROPOSAL 1)

1290 AvenueThe Board proposes that each of the Americas, 9th Floornine (9) director nominees described below (the “Nominees”), who currently are members of our Board, be re-elected for a one-year term expiring at our 2020 Annual Meeting and to serve until the due election and qualification of his or her successor, or until his or her earlier resignation or removal.

New York, NY 10104

Banks, BrokersIn November of 2018, the Board adopted resolutions to increase the size of the Board to ten (10) members. In addition to the eight (8) then existing directors, upon designation by Harbin and Shareholders

Call Toll-Free (888)607-9107

DESCRIPTION OF THE SHARE ISSUANCE

While we believe thatbased on the summary below describesrecommendation of the materialBoard’s Nominating and Corporate Governance Committee, the Board appointed Hsing Chow and Yong Kai Wong to the Board, effective January 22, 2019, in accordance with the terms of the Share Issuance,Stockholders Agreement. Messrs. Chow and Wong are included in the nominees for re-election below. In February 2019 the Board size was further increased to eleven (11) members, and in April 2019, upon designation by Harbin and based on the recommendation of the Board’s Nominating and Corporate Governance Committee, the Board appointed Michele S. Meyer to the Board, effective immediately, in accordance with the terms of the Stockholders Agreement. Ms. Meyer is included in the nominees for re-election below. Harbin has additional contractual rights to nominate up to two (2) additional directors to the Board, provided that each such additional nominee satisfies the requirements set forth in the Stockholders Agreement. As of the date of this Proxy Statement, Harbin has not yet exercised this optional right with respect to the final two positions.

Two of the Company’s current directors, Jeffrey Berger and Richard Wallace, have notified the Company of their intention to retire from the Board as of the date of the Annual Meeting, and as such are not included in this proxy statement as Nominees for re-election. The Company thanks them for their service. The Board’s Nominating and Corporate Governance Committee is working collaboratively with Harbin to fill the remaining board seats as soon as qualified candidates, as outlined in the Company’s governance documents and the Stockholders Agreement, are found.

All of the Nominees have indicated their willingness to serve if elected. If, at the time of the meeting, any Nominee is unable or unwilling to serve, shares represented by properly executed proxies will be voted at the discretion of the persons named therein for such other nominee as the Board (or Harbin pursuant to its existing designation rights) may designate, or the Board may elect to decrease the size of the Board.

Set forth below is information concerning each Nominee, and the key experience, qualifications and skills he or she brings to the Board.

Recommendation

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES AS DIRECTORS.

The Nominees

Kenneth A. Martindale, 59, became our Chief Executive Officer and a director on September 11, 2017. He was subsequently elected as Chairman of the Board in August, 2018. Mr. Martindale was previously CEO of Rite Aid Stores, a position held since August 3, 2015, and President of Rite Aid Corporation, a position held since June 2013. He previously served as Rite Aid’s Chief Operating Officer since June 2010. From December 2008 until June 2010, he served as Rite Aid’s Senior Executive Vice President and Chief Merchandising, Marketing and Logistics Officer. He served as co-President and Chief Merchandising and Marketing Officer for Pathmark Stores, Inc. from January 2006 until its acquisition by the Great Atlantic & Pacific Tea Company in December 2007. Mr. Martindale serves as a director of Fairway Group Holdings Corporation. Mr. Martindale’s years of executive leadership experience in retail operations led to the conclusion that he should serve as a director on the Board.

Robert F. Moran, 68, became one of our directors in June 2013 and served as our Interim Chief Executive Officer from July 2016 through September 10, 2017. He served as Non-Executive Chairman of the Board from September 2017 through August 2018, after which time he was elected as Lead Independent Director. Mr. Moran most recently served as Chairman and Chief Executive Officer of PetSmart, Inc., a leading specialty provider of pet products, services and solutions (“PetSmart”), from February 2009 to June 2013. Prior to being appointed Chairman, Mr. Moran was PetSmart’s President and Chief Executive Officer from June 2009 to January 2012

5

and its President and Chief Operating Officer from December 2001 to June 2009. Before joining PetSmart in 1999, Mr. Moran was President of Toys “R” Us Canada. Mr. Moran served on the boards of directors of Collective Brands, Inc. from March 2005 to October 2012 and of PetSmart from September 2009 to June 2013. He currently serves on the boards of directors of Hanesbrands, Inc., for which he chairs the audit committee, and the USA Track & Field Foundation. Mr. Moran’s more than 40 years of executive leadership experience, both domestically and internationally, and extensive retail experience and expertise led to the conclusion that he should serve as a director on the Board.

Hsing Chow, 52, became one of our directors in January 2019, pursuant to the terms of the Stockholders Agreement with Harbin. Since 2015, Mr. Chow has served as Group Vice President of Harbin. Prior to his service at Harbin, Mr. Chow served as Regional General Manager at Flextronics Global OPS, a leading electronics manufacturing services provider focused on delivering complete design, engineering and manufacturing services to automotive, computing, consumer, industrial, infrastructure, medical and mobile OEMs. Mr. Chow holds both a Bachelor of Science and Master of Science degree from New Jersey Institute of Technology. Mr. Chow’s designation by Harbin pursuant to the terms of our Stockholders Agreement, along with his business and international experience, led to the conclusion that he should serve as a director on the Board.

Alan D. Feldman, 67, became one of our directors in June 2013. Mr. Feldman most recently served as Chairman, President and Chief Executive Officer of Midas, Inc., a provider of retail automotive services, from May 2006 until its merger with TBC Corporation in May 2012 and as its President and Chief Executive Officer from January 2003 until May 2006. From 1994 through 2002, Mr. Feldman held senior management posts at McDonald’s Corporation and, prior to that, with the Pizza Hut and Frito-Lay units of PepsiCo, Inc. Mr. Feldman also currently serves on the board of directors of Foot Locker, Inc., for which he chairs the compensation and management resources committee and serves as a member of the executive committee and the finance and strategic planning committee, and of John Bean Technologies Corporation, for which he chairs the audit committee and serves as a member of the nominating and governance committee. Mr. Feldman also serves as Chair of the University of Illinois Foundation. Mr. Feldman’s recognized leadership skills and years of broad-based experience in independent, franchised retail operations, brand management and customer relations led to the conclusion that he should serve as a director on the Board.

Michael F. Hines, 63, became one of our directors in November 2009. He served as Chairman of our Board from August 2014 to September 2017, and prior to that, served as our Lead Independent Director since July 2012. Mr. Hines was the Executive Vice President and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from 1995 to March 2007. From 1990 to 1995, he held management positions with Staples, Inc., most recently as Vice President, Finance. Earlier, he spent 12 years in public accounting, the last eight years with the accounting firm Deloitte & Touche, LLP in Boston. Mr. Hines serves on the board of directors of The TJX Companies, Inc., a retailer of apparel and home fashions (“TJX”), and is the chair of its audit committee and a member of its finance committee. He also serves on the board of directors of Dunkin Brands Group, Inc., the parent company of Dunkin’ Donuts and Baskin-Robbins, for which he chairs the audit committee and is a member of the nominating and corporate governance committee. Mr. Hines’s experience as a financial executive and certified public accountant, coupled with his extensive knowledge of financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of large retailers, led to the conclusion that he should serve as a director on the Board.

Amy B. Lane, 66, became one of our directors in June 2011. Ms. Lane was a Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., an investment bank, from 1997 until her retirement in 2002. Ms. Lane previously served as a Managing Director at Salomon Brothers, Inc., an investment bank, where she founded and led the retail industry investment banking unit. Ms. Lane serves on the board of directors of TJX, and is the chair of its finance committee and a member of its audit and executive committees. Additionally, she serves on the board of directors of Nextera Energy, Inc., an electric utility holding company, as the chair of its finance committee and a member of the compensation committee, and on the board of directors of Urban Edge Properties, a REIT spun off from Vornado Realty Trust. Ms. Lane’s experience as the leader of two investment banking practices covering the global retailing industry has given her substantial experience with financial services, capital markets, finance and accounting, capital structure, acquisitions and divestitures in the retail industry as well as management, leadership and strategy, which led to the conclusion that she should serve as a director on the Board.

6

Philip E. Mallott, 61, became one of our directors in July 2012. Mr. Mallott retired as Vice President, Finance and Chief Financial Officer of Intimate Brands, an intimate apparel and personal care retailer and former subsidiary of Limited Brands, Inc. Mr. Mallott formerly served as a director of Big Lots, Inc., including non-executive chair for four years until May 2017, and as chair of the audit committee for fifteen years. In addition to his Board service at Big Lots, Mr. Mallott also serves on multiple board committees for Defiance College and United Church Homes, Inc. Mr. Mallott previously served as a director of Tween Brands, Inc. from 2000 to 2009. Mr. Mallott’s experience as a certified public accountant, his service on the boards of other public companies and charitable organizations, and his experience in leadership roles with other retailers led to the conclusion that he should serve as a director on the Board.

Michele S. Meyer, 54, became one of our directors in April 2019, pursuant to the terms of the Stockholders Agreement with Harbin. Ms. Meyer currently serves as President and Senior Vice President of the snacks operating unit, a $2 billion enterprise within General Mills, a Minneapolis, Minnesota based Fortune 500 global foods company. Ms. Meyer joined General Mills in 1988, and has held key leadership roles during her 30 years of service, including as President and Senior Vice President, and as Business Unit Director, Vice President, of other units within General Mills. In her current role, Ms. Meyer has driven sales growth, and has grown market share within her unit in key categories. Ms. Meyer possesses significant international experience, and is well versed in corporate restructuring and has acquisition integration experience, which combined with her business acumen and leadership skills, has led to the conclusion that she should serve as a director on the Board.

Yong Kai Wong, 42, became one of our directors in January 2019, pursuant to the terms of the Stockholders Agreement with Harbin.Mr. Wong has served as Managing Director of CITIC Capital Holdings Limited, an affiliate of Harbin, since 2012. Mr. Wong holds a CSREP degree from Harvard University, a Masters of Business Administration from University of Chicago Booth School of Business and a Master of Laws (LLM) from the University of Cambridge. Mr. Wong’s designation by Harbin pursuant to the terms of our Stockholders Agreement, along with his business and international experience, led to the conclusion that he should serve as a director on the Board.

The affirmative vote of the holders of a majority of the votes cast by our stockholders in person or represented by proxy and entitled to vote at the Annual Meeting is required to approve this Proposal 1. Any Director who receives less than a majority of affirmative votes cast by our stockholders for re-election must offer to resign from the Board if he or she is not re-elected at the Annual Meeting.

Board Composition

The Board is currently composed of Kenneth A. Martindale, Jeffrey P. Berger, Hsing Chow, Alan D. Feldman, Michael F. Hines, Amy B. Lane, Philip E. Mallott, Michele S. Meyer, Robert F. Moran, Richard J. Wallace and Yong Kai Wong. The Board has adopted Corporate Governance Guidelines, which are available on the Corporate Governance page of the Investor Relations section of our website located at www.gnc.com and will be provided to any stockholder free of charge upon request. The Corporate Governance Guidelines provide that in the event the Chairperson of the Board is not an independent director, the Lead Independent Director of the Board is to serve as the chairperson of any meetings of the Board in executive session. Mr. Moran, an independent director, currently serves as Lead Independent Director of the Board.

In addition to the biographical information provided above for those Directors who are Nominees, set forth below is information concerning Messrs. Berger and Wallace, who currently serve on our Board, until their impending retirement at the Annual Meeting.

Jeffrey P. Berger, 69, became one of our directors in March 2011. Mr. Berger currently is a private investor. From 2008 until April 2013, Mr. Berger served as a consultant to H. J. Heinz Company, a leading producer and marketer of healthy and convenient foods (“Heinz”). From 2007 to 2008, Mr. Berger was the Chairman of Global Foodservice of Heinz. From 2005 to 2007, Mr. Berger was the Executive Vice President, President and Chief Executive Officer of Heinz Foodservice. From 1994 to 2005, Mr. Berger was President and Chief Executive Officer of Heinz North America Foodservice. Mr. Berger currently serves on the board of directors of Big Lots, Inc., a discount retailer.

7

Richard J. Wallace, 67, became one of our directors in July 2010. Mr. Wallace served as a Senior Vice President for Research and Development at GlaxoSmithKline, a global pharmaceutical company (“GSK”), from 2004 until his retirement in 2008. Prior to that, he served in various executive capacities for GSK and its predecessor companies and their subsidiaries from 1992 to 2004. Mr. Wallace is also a director of ImmunoGen, Inc., for which he serves as a member of the audit and nominating and governance committees.

Board Meetings in 2018

The Board held fifteen (15) meetings during our fiscal year ended December 31, 2018.

Director Attendance

During our fiscal year ended December 31, 2018, each of our incumbent directors attended at least 75% of all meetings of the Board and committees of which he or she was then a member. We encourage, but do not require, our directors to attend our annual meetings of stockholders. All of our current directors who were serving on the Board at the time of our 2018 Annual Meeting attended the meeting.

Director Independence

Our Common Stock is listed for trading on the NYSE under the symbol “GNC”. The Board, upon the findings of the Nominating Committee, has determined as part of its annual review, that each of Ms. Lane, Ms. Meyer, and Messrs. Moran, Feldman, Hines and Mallott is “independent” within the meaning of Rule 303A.02 of the NYSE Listed Company Manual, and no family relationships exist among such Nominees and any of our executive officers. During this review, the Board considered transactions and relationships between each nominee for director with the Company (either directly or as a partner, stockholder or officer of any organization that has a relationship with the Company), including any potential related party transactions, as discussed below under “Certain Relationships and Related Transactions,” to determine whether any such relationships or transactions were inconsistent with a determination that the nominee for director is independent in accordance with independence requirements under our Corporate Governance Guidelines and as implemented by the NYSE.

Leadership Structure

The Board has adopted guidelines that provide the Board with the discretion and flexibility to decide if the roles of the Chief Executive Officer and Chairperson of the Board are to be separate or combined. Currently, the roles are combined, with Mr. Martindale serving as both Chief Executive Officer and Executive Chairman of the Board. The Board has determined that this is currently the appropriate leadership structure due to the fact that Mr. Martindale possesses detailed insight of the issues, opportunities and challenges facing the Company and its business and thus is best positioned to develop agendas that ensure the Board’s time and attention are focused on the most critical matters. His combined role enables decisive leadership, ensures clear accountability and enhances the Company’s ability to develop a long-term strategy that best serves the interest of its stakeholders. Each director, other than Messrs. Martindale, Chow and Wong, is independent, and the Board believes that the independent directors provide effective oversight of management. To further strengthen our governance structure, the Company also maintains a presiding non-employee director, which position is currently held by Mr. Moran.

Our Board’s Role in Risk Oversight

The Board and its Committees play an active role in overseeing the identification, assessment and mitigation of risks that are material to the Company. In fulfilling this responsibility, the Board and its Committees, regularly consult with management to evaluate and, when appropriate, modify our risk management strategies. While certain categories of risk are allocated to a particular Board committee for oversight based on the committee’s respective areas of expertise, the entire Board is regularly informed about such risks through committee reports.

The Board regularly reviews information regarding our primary areas of risk assessment- strategic, executional, competitive, economic, operational, financial (credit, liquidity, tax), legal, compliance, regulatory and reputational, as well as the risks associated with each. The Audit Committee has responsibilities related to the oversight and management of cybersecurity and financial risks, including compliance matters, tax strategies, information security measures and the internal audit function. The Compensation and Organizational Development Committee of the Board (the “Compensation Committee”) is responsible for overseeing the management of risks relating to our executive compensation policies, philosophies, practices and arrangements.

8

The Finance Committee oversees risks related to financial planning and strategies, including capital structure, investments, liquidity and cash management, insurance programs, hedging policies, and our stock ownership profile. The Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) is responsible for managing risks relating to our director compensation policies and arrangements, the independence of the Board, director candidates, board and committee composition, and other corporate governance matters. The risk oversight function does not impact the structure of the Board.

Company management is charged with adequately identifying material risks that the Company faces in a timely manner; implementing strategies that are responsive to the Company’s risk profile and specific material risk exposures; evaluating risk and risk management with respect to business decision-making throughout the Company; and efficiently and promptly transmitting relevant risk-related information to the Board or appropriate committee, so as to enable them to conduct appropriate risk management oversight. For example, the Audit Committee receives quarterly reports from the Internal Audit department on key risk indicators and the Compliance function on legal and regulatory compliance. The Legal Department provides a litigation report to the Board at least annually. The Chief Information Officer, with participation from the Chief Information Security Officer, reports quarterly to the Audit Committee on information security and compliance, including program maturity, data access control, security tests and training, key investments and security incident response.

Board Committees

Each of the below Committees is a standing committee of the Board. The Board has adopted written charters for each of these committees, each of which is available on the Corporate Governance page of the Investor Relations section of our website located at www.gnc.com and will be provided to any stockholder free of charge upon request. Further, each member of the Audit Committee, the Compensation Committee, the Finance Committee and the Nominating Committee has been determined by the Board to be independent under the NYSE’s current listed company standards.

Audit Committee | Compensation and Organizational Development Committee | Nominating and Corporate Governance Committee | Finance Committee | |

Jeffrey P. Berger* | X | X | ||

Hsing Chow | ||||

Alan D. Feldman | Chair | X | ||

Michael F. Hines* | Chair | X | ||

Amy B. Lane | X | Chair | ||

Philip E. Mallot* | X | Chair | ||

Kenneth A. Martindale | ||||

Michele S. Meyer | ||||

Robert F. Moran | ||||

Richard J. Wallace | X | X | ||

Yong Kai Wong | ||||

Number of Meetings | Nine (9) | Six (6) | Five (5) | Five (5) |

X = Member

Chair = Chairperson

* = Financial Expert

Audit Committee

The Audit Committee, which is established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists entirely of directors who meet the independence requirements of the listing standards of the NYSE and Rule 10A-3 under the Exchange Act. Further, the Board has determined that each of Messrs. Berger, Hines and Mallott qualifies as an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K and has the attributes set forth in such section, and they each have accounting and financial management expertise within the meaning of the listing standards of the NYSE.

9

The principal duties and responsibilities of the Audit Committee are to:

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Compensation Committee

The Board has determined that each of Amy B. Lane, Philip E. Mallott, and Richard J. Wallace qualify as independent under the current NYSE Corporate Governance Standards.

The principal duties and responsibilities of the Compensation Committee are to:

Compensation Committee Interlocks and Insider Participation. For our fiscal year ended December 31, 2018, (i) no member of the Compensation Committee (a) served as one of our officers or employees during or preceding their tenure on the Compensation Committee or (b) had any relationship requiring disclosure under Item 404 of Regulation S-K, and (ii) none of our executive officers served as a director or member of the compensation committee of another entity whose executive officers served on the Board or the Compensation Committee. During our fiscal year ended December 31, 2018, our Compensation Committee included Amy B. Lane, Philip E. Mallott, and Richard J. Wallace.

Finance Committee

The principal duties and responsibilities of the Finance Committee are to:

10

Nominating and Corporate Governance Committee

The Board has determined that each of Jeffrey P. Berger, Richard J. Wallace and Alan D. Feldman qualify as independent under the current NYSE Corporate Governance Standards.

The principal duties and responsibilities of the Nominating and Corporate Governance Committee (the “Nominating Committee”) are as follows:

Director Qualifications; Nominating Committee Process. The Nominating Committee’s policy is to identify potential director nominees from any properly submitted nominations, including any properly submitted nominations from our stockholders, and subsequently evaluate each potential nominee. Stockholders may nominate director candidates for consideration by the Nominating Committee as set forth below.

In accordance with the Company’s amended and restated by-laws, to be timely for consideration by the Nominating Committee, notice of a proposed nomination must be delivered to or mailed and received at the Company’s principal executive offices not earlier than the opening of business on the 120th day nor later than the close of business on the 90th day prior to the one year anniversary of the date of the preceding year’s annual meeting of its stockholders; provided, however, that if the date of the annual meeting is more than 30 days prior to or delayed by more than 70 days after the anniversary of the preceding year’s annual meeting, the nomination must be received not earlier than the opening of business on the 120th day prior to the date of such annual meeting nor later than the later of the close of business on the (i) 90th day prior to the date of such annual meeting or (ii) 10th day following the day on which public announcement of such meeting date is first made.

In addition to information regarding the nominating stockholder as set forth in the Company’s amended and restated by-laws, in accordance with the Company’s corporate governance guidelines, such stockholder’s notice must set forth as to each individual whom the stockholder proposes to nominate for election or reelection as a director:

11

Any such submission must be accompanied by the written consent of the individual whom the stockholder proposes to nominate to being named in the proxy statement as a nominee and to serving as a director if elected.

The Nominating Committee may, but is not required to, consider nominations not properly submitted in accordance with the Company’s Corporate Governance Guidelines, and the Committee may request further information and documentation from any proposed nominee or from any stockholder proposing a nominee. All nominees properly submitted to the Company (or which the Nominating Committee otherwise elects to consider) will be evaluated and considered by members of the Nominating Committee using the same criteria as nominees identified by the Nominating Committee itself.

In addition to the above, under the terms of the Company’s current Stockholders Agreement entered into with Harbin, and pursuant to the terms of the current Sixth Amended and Restated Bylaws of the Company, so long as Harbin continues to hold at least fifteen percent (15%) of the Company’s Common Stock (calculated on an as-converted basis), Harbin has the right, but not the obligation, to designate up to two additional directors (each an “Investor Designee”) to the Board, in addition to the initial Investor Designees Messrs. Chow and Wong, and the third Investor Designee, Ms. Meyer.

In evaluating the suitability of individual candidates (both new candidates and current Board members), in recommending candidates for election, and in approving (and, in the case of vacancies, appointing) such candidates, the Nominating Committee considers, in addition to such other factors as it shall deem relevant, the desirability of selecting directors who:

In addition to the considerations set forth above, the Nominating Committee considers a candidate’s background and accomplishments and candidates are reviewed in the context of the current composition of the Board and the evolving needs of our businesses. The Nominating Committee conducts the appropriate and necessary inquiries (as determined by the Nominating Committee) with respect to the backgrounds and qualifications of any potential nominees, without regard to whether a potential nominee has been recommended by our stockholders, and, upon consideration of all relevant factors and circumstances, recommends to the Board for its approval the slate of director nominees to be nominated for election at our annual meeting of stockholders. Although the

12

Nominating Committee has not adopted a formal policy with respect to diversity, it does look for diversity of background (including, but not limited to, race, origin, age and gender) and experience in different substantive areas such as retail operations, marketing, technology, distribution and finance, as relevant factors in evaluating candidates.

2018 Director Compensation

The following table presents information regarding the compensation of our non-employee directors with respect to our fiscal year ended December 31, 2018 and should be read in conjunction with “Narrative to the Director Compensation Table” below. Employees of the Company do not receive any additional compensation for 2018 Board service. No information has been provided for Messrs. Chow or Wong or Ms. Meyer, as they did not join the Board of Directors until January and April 2019, respectively.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | All Other Compensation ($) | Total ($) | ||||||||

Jeffrey Berger | 102,500(3 | ) | 110,000 | — | 212,500 | |||||||

Alan Feldman | 112,500(4 | ) | 110,000 | — | 222,500 | |||||||

Michael Hines | 102,500(5 | ) | 110,000 | — | 212,500 | |||||||

Amy Lane | 112,500(6 | ) | 110,000 | — | 222,500 | |||||||

Philip Mallott | 120,000(7 | ) | 110,000 | — | 230,000 | |||||||

Robert Moran | 175,000(8 | ) | 110,000 | — | 285,000 | |||||||

Richard Wallace | 115,000(9 | ) | 110,000 | — | 225,000 | |||||||

| (1) | Reflects the approximate aggregate grant date fair value of the 2018 annual restricted stock awards granted to each of the directors computed in accordance with FASB ASC Topic 718. For the assumptions underlying the calculation of the aggregate grant date fair value, see Note 16, “Stock-Based Compensation,” to our audited consolidated financial statements included in the Annual Report. The 2018 annual awards were granted on May 21, 2018, had an approximate aggregate grant date fair value of $110,000 for each director and the restrictions with respect to the restricted stock is scheduled to lapse on the first anniversary of the grant date, provided the director has remained in service until the vesting date. |

| (2) | The table below sets forth the number of stock awards and the exercisable and unexercisable stock options received for services as a director and held by the listed directors as of December 31, 2018. Ms. Lane elected to defer her 2018 annual restricted stock award of 31,609 shares, and as such will not be issued shares from the award until separation from service. |

Stock Awards Outstanding | Option Awards Outstanding | ||||||||

Name | Exercisable | Unexercisable | |||||||

Jeffrey Berger | 31,609 | 14,000 | — | ||||||

Alan Feldman | 31,609 | — | — | ||||||

Michael Hines | 31,609 | 11,920 | — | ||||||

Amy Lane | — | — | — | ||||||

Philip Mallott | 31,609 | — | — | ||||||

Robert Moran | 31,609 | — | — | ||||||

Richard Wallace | 31,609 | 35,000 | — | ||||||

| (3) | Reflects aggregate annual retainers paid to Mr. Berger, including $80,000 for his service as a director, $10,000 for his service as a member of the Nominating Committee and $12,500 for his service as a member of the Audit Committee. |

| (4) | Reflects aggregate annual retainers paid to Mr. Feldman, including $80,000 for his service as a director, $10,000 for his service as a member of the Nominating Committee, $12,500 for his service as Chairperson of the Nominating Committee and $10,000 for his service as a member of the Finance Committee. |

| (5) | Reflects aggregate annual retainers paid to Mr. Hines, including $80,000 for his service as a director, $12,500 for his service as a member of the Audit Committee, and $10,000 for his service as a member of the Finance Committee. Fees for his service as Chairperson of the Audit Committee, which began in December 2018, commenced with the first quarter 2019 payments. |

| (6) | Reflects aggregate annual retainers paid to Ms. Lane, including $80,000 for her service as a director, $10,000 for her service as a member of the Compensation Committee, $12,500 for her service as Chairperson of the Finance Committee and $10,000 for her service as a member of the Finance Committee. |

| (7) | Reflects aggregate annual retainers paid to Mr. Mallott, including $80,000 for his service as a director, $12,500 for his service as a member of the Audit Committee, $17,500 for his service as Chairperson of the Audit Committee, and $10,000 for his service as a member of the Compensation Committee. Fees for his service as Chairperson of the Compensation Committee, which began in December 2018, commenced with the first quarter of 2019. |

| (8) | Reflects aggregate annual retainers earned by Mr. Moran, including $80,000 for his service as a director, $82,500 for his service as Chairman of the Board through June, 2018, and $12,500 for his service as Lead Independent Director beginning July, 2018. |

| (9) | Reflects aggregate annual retainers paid to Mr. Wallace including $80,000 for his service as a director, $10,000 for his service as a member of the Nominating Committee, $15,000 for his service as Chairperson of the Compensation Committee, and $10,000 for his service as a member of the Compensation Committee. The change in fees related to his change in service as Chairperson of the Compensation Committee, which began in November 2018, commenced with the first quarter 2019 payments. |

13

Narrative to the Director Compensation Table. Our current director compensation policy (the “Director Compensation Policy”), adopted in 2013, provides that each non-employee director is entitled to receive an annual cash retainer for Board service, additional cash retainers service as a Committee member and/or Chairperson and an annual equity award. The Board believes that payments of retainer fees provide an appropriate balance of incentives for active participation and ease of administration, while the grant of annual equity awards aligns the long-term financial interests of our directors and our stockholders.

Specifically for 2018, our non-employee directors received (i) an $80,000 annual cash retainer for Board service, (ii) as applicable, an incremental annual cash retainer of $17,500, $15,000, $12,500 or $12,500 for service as Chairperson of the Audit Committee, Compensation Committee, Finance Committee or Nominating Committee, respectively, (iii) as applicable, an incremental annual cash retainer of $12,500 or $10,000 for service on the Audit Committee or another standing Committee, respectively, and (iv) annual equity award, in the form of restricted stock with one year cliff vesting, valued at $110,000 at the time of grant. For information regarding Compensation Committee Interlocks and Insider Participation, see “Other Board Information” above. In addition to the compensation noted above, the Chairman of the Board is entitled to receive an annual, incremental cash retainer, which in 2018 was $110,000. Additionally, in August, 2018 the annual cash retainer for the Lead Independent Director was established at $50,000. The annual cash retainers paid to our non-employee directors under the Director Compensation Policy are generally paid in four equal quarterly installments every March, June, September and December, and the annual equity award is typically granted in May.

We also maintain a deferred compensation plan under which our non-employee directors may elect to defer all or a portion of their compensation until the earliest of separation from the Board, death, a specified future date or a change in control of the Company. Annual equity retainers are deferred in the form of RSUs with identical vesting schedules to the shares of restricted stock. Ms. Lane elected to defer her 2018 annual restricted stock award and will not containbe issued shares from the award until separation from service.

Director Stock Ownership Guidelines. We believe that to align the interests of our non-employee directors with our stockholders, our directors should have a financial stake in the Company. The Board adopted a policy in December 2011 requiring each of our non-employee directors to own stock in the Company equal to a minimum of five times such director’s annual cash retainer for service on the Board (the “Director Stock Ownership Guidelines”). Any newly elected directors have five years from the date of their election to comply with the Director Stock Ownership Guidelines, and should retain at least 50% of all after-tax shares owned by or underlying equity awards granted to them (other than those granted on or prior to December 11, 2012) until the ownership thresholds are met. The Nominating Committee evaluates potential hardship exceptions for directors due to financial considerations or other appropriate reasons, including changes in value resulting from volatility in our share price. For the purposes of the Director Stock Ownership Guidelines, stock includes (i) directly held shares of our Common Stock, (ii) shares of unvested restricted stock and unvested RSUs (other than unvested shares of performance-vested restricted stock or unvested performance-vested restricted stock units) and (iii) vested shares of Common Stock allocated to the account of a non-employee director who was formerly an employee of the Company under any plan qualified under Section 401(a) of the Internal Revenue Code of 1986, as amended.

Code of Ethics

We have adopted a Code of Ethics applicable to our Chief Executive Officer and senior financial officers and a Code of Business Conduct and Ethics that is applicable to all employees. Each document is available on the Corporate Governance page of the Investor Relations section of our website located at www.gnc.com, and will be provided to any stockholder free of charge upon request. Any amendments to or waivers from our Code of Ethics with respect to our Chief Executive Officer and senior financial officers will also be disclosed on our website. Employees generally receive annual training with respect to the Code of Business Conduct and Ethics, and are required to acknowledge that they understand their responsibilities and will comply with all aspects of the Code of Business Conduct and Ethics.

Certain Relationships and Related Transactions

We recognize that transactions between the Company and related persons present a potential for actual or perceived conflicts of interest. Our general policies with respect to such transactions are included in our Code of Business Conduct and Ethics. All employees are required to follow the Code of Business Conduct and Ethics,

14

and the Audit Committee of the Board, along with Corporate Compliance staff led by our Chief Legal Officer, oversee our Code of Business Conduct and Ethics, which provides that any actual or potential conflict of interest is to be disclosed.

Although we have not adopted formal written procedures for the review, approval or ratification of transactions with related persons, the Board reviews potential transactions with those parties we have identified as related parties prior to the consummation of the transaction, and we adhere to the general policy that such transactions should only be entered into if they are approved by the Board, in accordance with applicable law, and on terms that, on the whole, are no more or less favorable than those available from unaffiliated third parties. In 2018, we did not participate in any transactions involving an amount in excess of $120,000 in which any related person (as defined in Instruction 1 to Item 404(a) of Regulation S-K) has or will have a direct or indirect material interest.

Communications from Stockholders and Other Interested Parties

The Board welcomes communications from our stockholders and other interested parties. Stockholders and other interested parties wishing to communicate with the Board, our non-management directors or any particular director may send such communications to the following address: GNC Holdings, Inc., 300 Sixth Avenue, Pittsburgh, Pennsylvania, 15222, Attention: Secretary. Such communications should indicate clearly the director or directors to whom the communication is being sent so that each communication may be forwarded directly to the appropriate director(s).

Board Tenure and Evaluations

As noted in the Company’s Corporate Governance Guidelines, it is the general policy of the Company that no director may stand for election to the Board after his or her 72nd birthday and that no director may serve on the Board for more than fifteen years. However, it is not the intent of the Company that a director reaching retirement age or period of service limitations would prevent the director from continuing to serve the Company in a different capacity, such as Director Emeritus or as a consultant.

Both the full Board, as well as each Board Committee discussed within this proxy statement, completes an annual self-assessment, which is a structured, confidential questionnaire prepared by the legal department. The results of the questionnaires are reviewed and discussed, as applicable, within executive session, and further used to develop action plans in response to comments provided in said questionnaires.

Policy on Hedging and Pledging of Company Stock

The Company currently has a policy in place that is applicable to all employees and non-employee directors, which prohibits such persons from (i) within six months after purchasing any Company securities, selling any Company securities of the same class, (ii) selling the Company’s securities short, (iii) buying or selling puts or calls or other derivative securities on the Company’s securities, (iv) holding Company securities in a margin account or pledging Company securities as collateral for a loan or (v) entering into hedging or monetization transactions or similar arrangements with respect to Company securities.

15

Set forth below is information concerning our current executive officers.

Name | Age | Position |

Kenneth A. Martindale | 59 | Chief Executive Officer |

Tricia K. Tolivar | 50 | Executive Vice President, Chief Financial Officer |

Guru Ramanathan | 56 | Senior Vice President, Chief Innovation Officer |

Kevin G. Nowe | 66 | Senior Vice President, Chief Legal Officer and Secretary |

Steven Piano | 53 | Senior Vice President, Chief Human Resources Officer |

Susan M. Canning | 49 | Vice President, Deputy General Counsel and Corporate Secretary |

The biography for Mr. Martindale is set forth above under “Election of Directors (Proposal 1).”

Tricia K. Tolivar became our Executive Vice President and Chief Financial Officer in March 2015. She served as our Interim Chief Marketing Officer in June 2017 through April 2018. In October 2018, Ms. Tolivar assumed responsibility and oversight of the Company’s real estate function. Previously, Ms. Tolivar served in leadership positions with Ernst & Young, LLP from October 2007 to February 2015, including most recently as Americas Director of Finance, Advisory, with responsibility for the leadership of finance, accounting and operations of a $3 billion client service organization in North and South America. Ms. Tolivar previously served as Chief Financial Officer of the Greater Memphis Arts Council from January 2006 to December 2008 and in a series of executive leadership positions with AutoZone, Inc. from 1996 to 2005. She is a graduate of Emory University.

Guru Ramanathan, Ph.D. joined our Company in 1998 and became our Senior Vice President and Chief Innovation Officer in December 2009 having previously served as Senior Vice President of Product and Package Innovation since February 2008 and Senior Vice President of Scientific Affairs since April 2007. He served as Vice President of Scientific Affairs from December 2003 to April 2007. Prior to joining the Company, Dr. Ramanathan worked as Medical Director and Secretary for the Efamol subsidiary of Scotia Pharmaceuticals in Boston and, in his capacity as a pediatric dentist and dental surgeon, held various industry consulting and management roles, as well as clinical, research and teaching appointments in Madras, India, and Tufts University and New England Medical Center in Boston, Massachusetts. Dr. Ramanathan earned his Ph.D. in Innovation Management from Tufts University and his MBA from Duke University’s Fuqua School of Business.